Make checks payable to "Within Reach Global"

and send to:

Within Reach Global

P.O. Box 1591

Prescott, AZ 86302

Tax receipts will be mailed at the end of the year. Within Reach Global Inc. is a US 501 (c)(3) public charity, EIN: 26-3499455

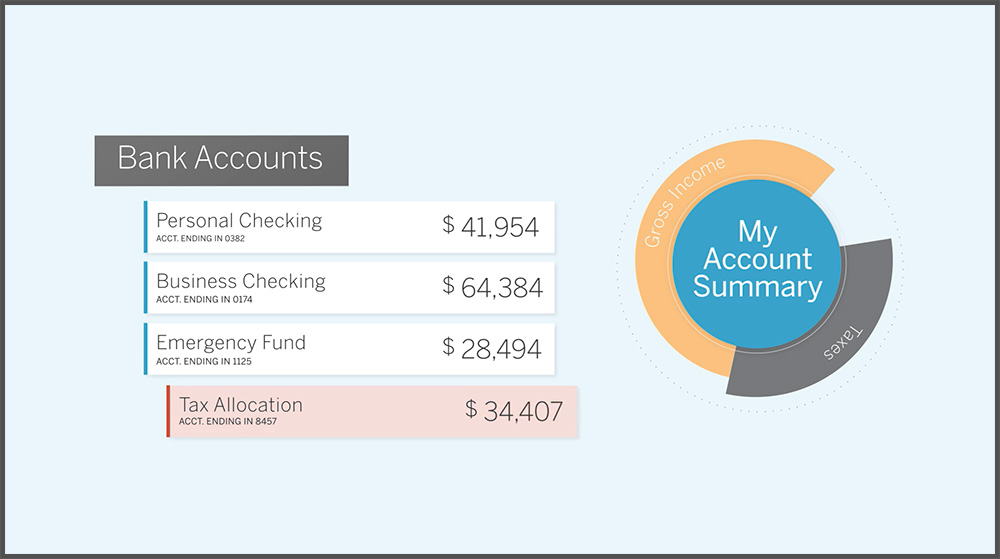

All cash giving is directed to Within Reach Global Inc. All non-cash giving is directed to the Within Reach Global Single-Charity Fund (#3717102) at National Christian Foundation.

For smart giving opportunities, please contact National Christian Foundation Generosity Ambassador, Georgia, Matthew Hendley.

For smart giving opportunities, please contact National Christian Foundation Generosity Ambassador, Georgia, Matthew Hendley.

2025 Impact Report

If you have given to Within Reach Global in the past, download the 2025 Impact Report to see how your generosity impacted unreached communities. If you’re considering donating for the first time, learn what God has done before and how He can use you to impact future generations.

General Information

Legal Name: Within Reach Global, Inc.

Federal Tax ID Number (EIN Number): 26-3499455

Address: P.O. Box 1591, Prescott, AZ 86302

Make all checks payable to “Within Reach Global” and send to:

Within Reach Global, P.O. Box 1591, Prescott, AZ 86302

Within Reach Global is a Candid Guidestar Platinum Transparency 2025 non-profit organization. Learn more at Guidestar.

Within Reach Global is a Candid Guidestar Platinum Transparency 2025 non-profit organization. Learn more at Guidestar.

Yes! Both Within Reach Global, Inc. and National Christian Foundation are 501(c)(3) tax-exempt charitable organizations. When you give through WRG or NCF you will receive a gift receipt via the address you provided.

Legal Name: Within Reach Global, Inc.

Federal Tax ID Number (EIN Number): 26-3499455

Address: P.O. Box 1591, Prescott, AZ 86302

Legal Name: National Christian Charitable Foundation Inc.

Federal Tax ID Number (EIN Number): 58-1493949

Address: 11625 Rainwater Dr. Suite 500, Alpharetta, GA 30009-8678

For all general inquiries about your giving, please contact the Within Reach Global Secretary, Mark Tawlks:

Mark Tawlks, WRG Secretary

Within Reach Global

Mobile: +1.707.688.7800

mark.tawlks@withinreachglobal.org